http://www.tax.ny.gov/start

E-File Free Directly to the IRS. Based On Circumstances You May Already Qualify For Tax Relief.

Farmers School Tax Credit Tax Credits Tax Farmer

If you dont already have an account its easy to create one.

. If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out. Sales Tax Web File. Registered Sales Tax Vendor Lookup.

Enter the security code displayed below and then select Continue. The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes. Visit the NYS Business Wizard to determine the requirements for your business and apply for the right license or permit.

The following security code is necessary to prevent unauthorized use of this web site. Sole proprietorships and general partnerships file in the county where theyre located. NYS-45 upload for use by authorized agents only.

You can start anywhere in the series or review all the modules. Property taxes and assessments. The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners.

An existing homeowner who is not receiving the STAR exemption or credit. Understand State licensing and permitting. The following security code is necessary to prevent unauthorized use of this web site.

Department of Taxation and Finance. STAR resource center. MCTMT - File Upload.

The combined income of all owners and their spouses who reside at the property cannot be more than 92000. Find sales tax rates. Register or Renew.

Income Tax Refund Status. Department of Taxation and Finance. Free Case Review Begin Online.

With an Online Services account you can make a payment respond to a letter from the department and moreanytime anywhere. Select the Services menu from the upper-left corner of your Account Summary homepage. Business tax-free New York area elimination credit.

If you are using a screen reading program select listen to have the number announced. The 10-digit PIN is located in the top right corner of. Not as an individualBusiness NYgov ID may be used by representatives of companies partnerships sole proprietorships or organizations.

A manufactured homeowner who received a letter that you must register for the STAR credit to continue receiving a STAR benefit Form RP-425-RMM. E-FIle Directly to New York for only 1499. For businesses with 100 of their operations assets and payroll in a tax-free area s the credit would eliminate any tax liability.

Ad Free 2021 Federal Tax Return. The application that you are requesting can only be accessed after a successful login. Enter the security code displayed above.

A senior who may be eligible for the Enhanced STAR credit. Modules and videos designed to take you through the benefits available to you and the responsibilities you have as a New York State taxpayer. Quarterly withholding tax returns Forms NYS-45 and NYS-45-ATT are due Monday May 2 2022.

The online application process only takes about 5 minutes to file the EIN online and the number will be ready in seconds. Business NYgov ID - Allows you to access online services that require your business organizations unique identity must be verified where you are acting in a business capacity as an authorized representative of the business ie. If you are eligible and enrolled in the STAR program youll receive your benefit each year in one of two ways.

If you are registered for the STAR credit the Tax Department will send you a STAR check. - Select to learn more about a particular field. Please log back into your account to.

Choose the online service you need from Employment and withholding. The following security code is necessary to prevent unauthorized use of this web site. If you are using a screen reading program select listen to have the number announced.

Partnering with these schools gives. New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. Eligible New Yorkers have more free e-file options than ever with brand-name Free File software.

You can even get an EIN over the phone if the company was formed outside. This credit would be calculated by the business when filing its tax return. Apply for a Certificate of Authority for your business to start making taxable sales in New York State.

If you have any further issues please contact us for assistance. File Your New York State Income Tax Return. Income is federal adjusted gross income minus the taxable amount of total distributions from annuities or individual retirement accounts commonly known as IRAs.

You can only access this application through your Online Services account. File and pay other taxes. START-UP NY helps new and expanding businesses through tax-based incentives and innovative academic partnerships.

Enter your social security number the PIN from your letter and the security code displayed below. For businesses with operations in and out of a tax-free area the credit would be. The recently enacted New York State budget suspended certain taxes on motor fuel and diesel motor fuel effective June 1 2022.

Online Services is the fastest most convenient way to do business with the Tax Department. Now that youve filed check the status of your tax refund. E-File Directly to the IRS State.

START-UP NY offers new and expanding businesses the opportunity to operate tax-free for 10 years on or near eligible university or college campuses in New York State. You must first login to access your Online Service Application. If applying online isnt an option you can also complete an EIN application by mail or fax by sending Form SS-4 to the IRS fax number 855-641-6935.

Business Corporations file a Certificate of Incorporation with the. If you are already receiving the STAR credit you do not. Most New York City employees living outside of the 5 boroughs hired on or after January 4 1973 must file Form NYC-1127.

The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older. Enter the security code displayed below and then select Continue. Non-resident Employees of the City of New York - Form 1127.

MCTMT - Employers Quarterly Return. Ad See If You Qualify For IRS Fresh Start Program. The START-UP NY program provides tax benefits to approved businesses that locate in vacant space or land of approved New York State public and private colleges and universities approved strategic state assets and New York State incubators affiliated with private universities or colleges that are designated as tax-free NY areas.

If you are using a screen reading program select listen to have the number announced.

Chat With A Certified Enrollment Assistor For Free How To Plan Health Care Health

Some Teleworkers Could Be Hit With Surprise Tax Bills Tax Accountant Accounting Firms Cpa

Www Tax Ny Gov Pdf Current Forms Misc Dtf505 Fill In Pdf Filling Pdf Current

Steps To Starting Your Own Business In 2022 Starting Your Own Business Starting A Business Opening Your Own Business

New York Business Express Application To Register For A Sales Tax Certificate Of Authority Business Online Business Express

Find Out More About The Small Business Marketplace Small Business Tax How To Plan Business Tax

Brass Taxes The Best Tax Accountants For Freelancers The Fearless Foreigner In 2022 Tax Accountant Accounting Europe Trip Itinerary

Create The Perfect Design By Customizing Easy To Use Templates In Minutes Easily Convert Your Image De Tax Preparation Income Tax Preparation Business Account

Tax Consulting Services Instagram Tax Consulting Video Ads Tax

How To Start A Business In New York Tax Info Starting A Business Business Online Business

Real Estate Home Page I Ofspace Corporate Design Modern Web Design Estate Homes

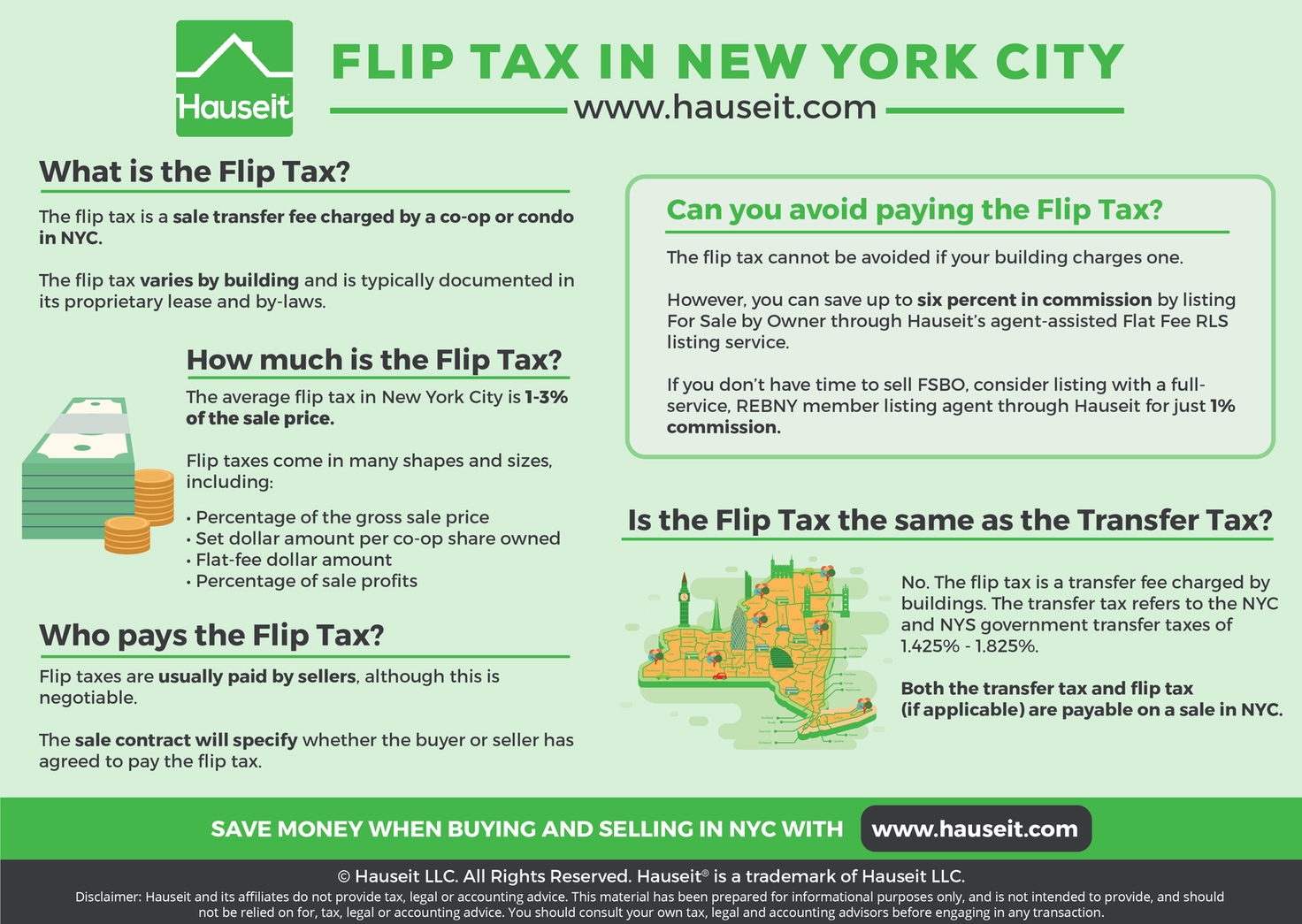

What Is The Average Flip Tax In Nyc And Who Pays It Learn More Https Goo Gl Ccm8nz Nyc Closing Costs Tax

212 Tax Accounting Services In Nyc Video In 2022 Accounting Services Accounting Business Tax

We Re All Set For The Bronx Career Expo At Hostoscollege Today From 11 3 Http Www Labor Ny Gov Bronxexpo Bronxexpo Basketball Court Expo Bronx

Tax Services Tax Services Accounting Services Income Tax Return

Increased Tax Credits Available Health Plan How To Plan Tax Credits

Currently Non Collectible Status Cnc Ny Ny 10035 Www Mmfinancial Org Irs Taxes Internal Revenue Service Irs

Usa Building Company Earning Statement Template In Word A In 2022 Statement Template Document Templates Words

The Pink Tax Why Women S Products Often Cost More Pink Tax Tax Quote Women